Asset Turnover Ratio Standard

Starting our Asset Turnover Ratio calculation we first need to adjust sales. Compare the result to the industry standards and competitors.

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

This is an efficiency ratio and therefore it focuses on how efficiently companies use their average total assets to generate sales.

. The asset turnover ratio is a financial ratio that measures how much sales a company generates from its assets. Imagine Company A has made 500000 in net sales and has 2000000 in total assets. Asset turnover is sales divided by assets and asset turnover is correctly expressed both as a percentage or as x times.

Asset turnover is a measure of how efficiently management is using the assets at its disposal to promote sales. 74 rows Asset turnover days - breakdown by industry. More about asset turnover days.

In other words the company is generating 1 dollar of sales for every dollar invested in assets. Read Fixed Assets to Net Worth Ratio. A higher number indicates that youre using your assets efficiently.

For instance a ratio of 1 means that the net sales of a company equals the average total assets for the year. As we dont have detailed data on returns and doubtful debt allowances we can use the average percentages we know. From the above table one can see that BPCL has the highest asset turnover ratio of 287 which means for every 1 rupee invested in assets 287 rupees sales are generated.

Check the details of asset turnover ratio. Above formula and net sales value as follows. You can use the asset turnover rate formula to find out how efficiently theyre able to generate revenue from assets.

In other words this ratio allows you to see how well the company is able to use its property plant and equipment PPE to generate net sales. Revenue Average total assets or in days 365 Asset turnover. Upon doing so we get 20x for the total asset turnover.

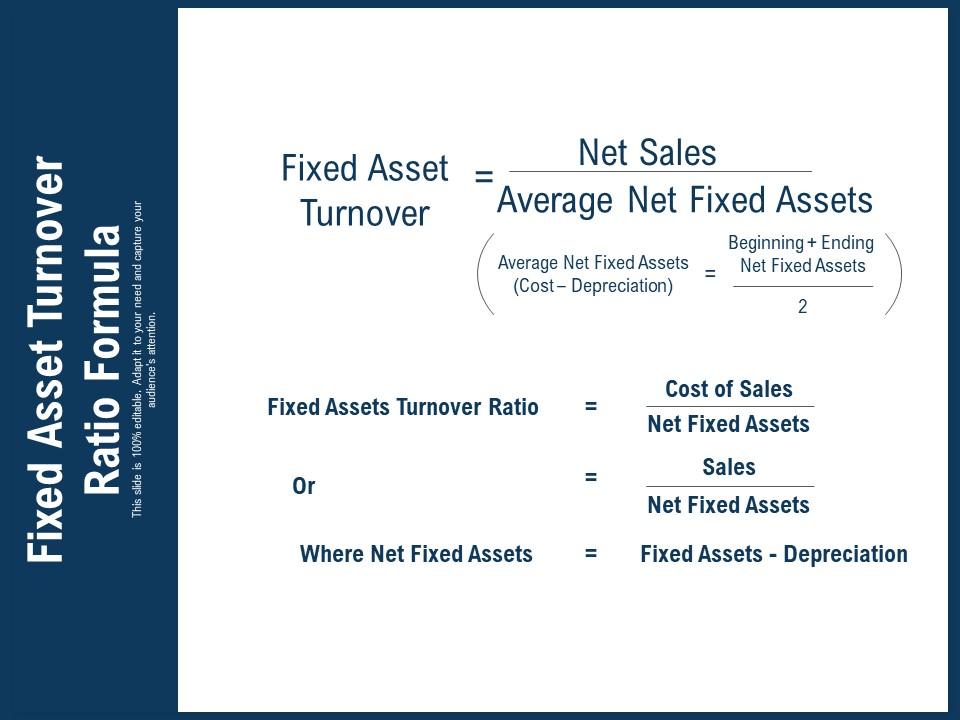

The fixed asset turnover ratio FAT is in general used by analysts to measure operating performance. The asset turnover ratio is an efficiency ratio that measures and helps analyse a companys ability to generate sales from its assets by comparing net sales with average total assets. A high asset turnover ratio indicates that a company uses its resources efficiently while a low value means that the company requires improvement.

As noted by Accounting Tools companies with a high asset turnover. What is Asset Turnover Ratio. Now we have Net Sales 70000.

Like with most ratios the asset turnover ratio is based on industry standards. All told for the asset turnover ratio the higher the better. The Asset Turnover ratio can often be used as an indicator of the.

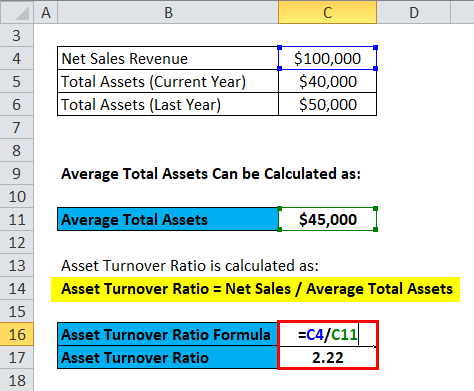

The asset turnover ratio measures the efficiency with which a company uses its assets to generate sales by comparing the value of its. Asset turnover ratio Net sales Average asset value. You get 05 so 05 is basically your answer.

Once this same process is done for each year we can move on. Listed companies included in the calculation. Net Sales 75000 5000 70000.

Average Total Assets as 140000 and put these value to this formula we get Asset Turnover Ratio 70000 140000 05. Some industries use assets more efficiently than others. This leads to a high average asset turnover ratio.

This efficiency ratio compares net sales income statement to fixed assets balance sheet. IOCL has the lowest asset turnover ratio of the three companies but at least it is greater than 1 which is a good. Is High asset turnover good or bad.

For example if Tractorco has 40 million of assets and 100 million of sales then its asset turnover is 250 or 25x. There is no single standard to determine a good asset turnover ratio. 500000 2000000 025 x 100 25.

This means that Company As assets generate 25 of net sales relative to their value. For instance an asset turnover ratio of 14 means youre generating 140 of sales for every dollar of assets your. Using the Under Armour case 20 materials Book is Strategic Management and Business Policy-Globalization Innovation and sustainability Fourteenth Edition and the Under Armour website research Under Armour and conduct a financial ratio analysis for the most recent 2 fiscal years 2008 2009 using the following ratios found in Table 12-1 p336-338.

Toll Free 1800 309 8859 91 80 25638240. To calculate the total asset turnover ratio you have to divide sales turnover by the total assets. To calculate the ratio in Year 1 well divide Year 1 sales 300m by the average between the Year 0 and Year 1 total asset balances 145m and 156m.

The objective of calculating a companys fixed asset. Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets. The fixed asset turnover ratio is a type of efficiency ratio measuring a companys ability to generate net sales using its fixed assets.

Asset Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Comments

Post a Comment